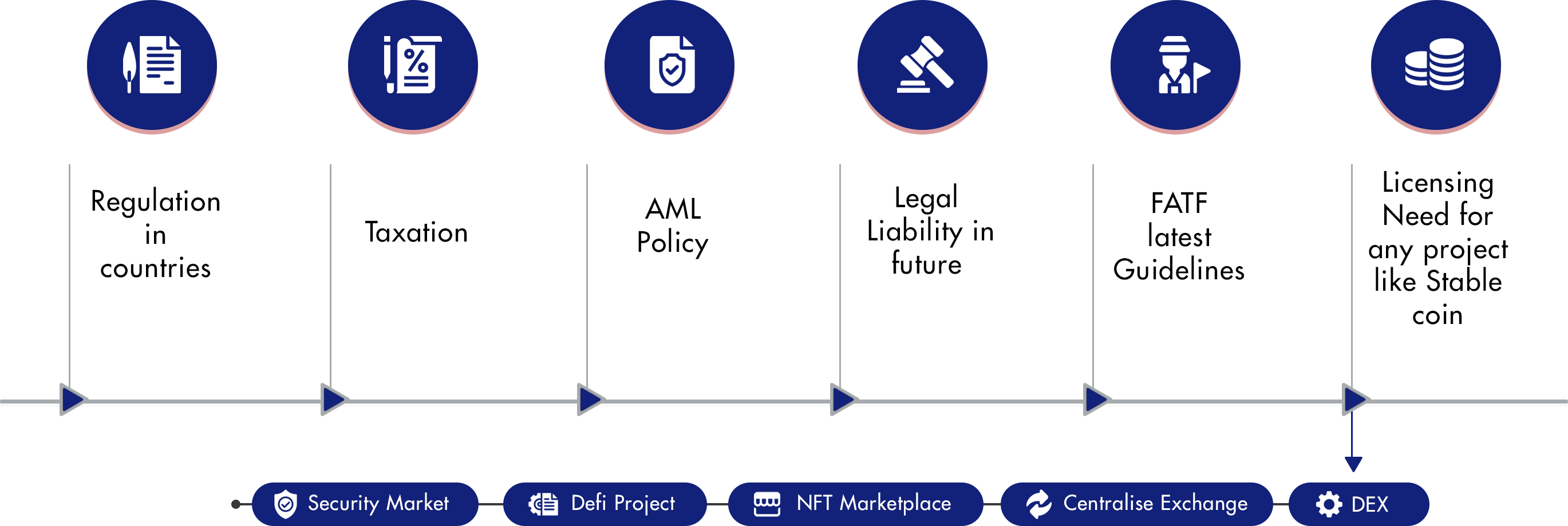

Need to answer the following question before starting a Blockchain based Project ?

Is your business following the Latest FATF guidelines?

- What is the risk-based approach to virtual assets recommended by the FATF?

- The risk-based approach to counteracting money-laundering and terrorism-financing applies to all direct and indirect virtual asset service providers

- National coordination

- The international success of this approach will have a lot to do with the regulatory procedures put in place at a local and regional level

- Mitigating ML/ FT risk

The guidance set out by the FATF recommends first understanding and then mitigating risk by means of

Transparency and regulatory

co-operation

Ongoing

monitoring

As theft and fraud in the blockchain industry increases, consistent monitoring.Our expert teams advice will help you to strengthen your AML and CFT procedures as per the FATF Red Flag Indicators Report.

Looking at the current situation whole world is confused about Crypto Regulation & there are several question in Governments Mind .When you deal with decentralise space,risk is really high as return is high.We as lawyers understand that dealing with crypto means playing with International Law dealing with

Money Laundering

Terrorism

CIS

Personal Data theft

Our Expert Lawyer Provide Following Services for your legal protection from any Litigation.

Our lawyers provide legal advice on :

Bitcoin Regulation

Company Incorporation

Taxation Issues and Disputes

Shareholder Agreements

Mining Pool Agreements

Joint Venture Agreements

Money Exchange Regulation

Digital Currency Regulation

Breach of Contract involving Bitcoin

Disputes involving digital currency may arise in relation to, for instance:

“By its very nature, DeFi is designed to be permissionless and, currently, operates within the ‘grey’ area of the financial industry — which, as we know, is a highly-regulated market. Currently, DeFi operators seem to have an unspoken ‘code of conduct’ in which they are good players in the space. Regulators are clearly watching the space carefully and, as we know, are reactive in approach rather than proactive. One transaction could topple the apple cart, so to speak.”

the contractual relationship between the parties

a claimant trying to recover Bitcoins or access to a private key

a criminal matter such as fraud or money laundering

divorce, if a party is allegedly using digital currency to hide assets

hiding assets in the course of commercial litigation

an issue of company or commercial law

intellectual property such as patents

Our digital currency specialists are at the forefront of Smart Contracts, with plans to launch digitalised legal agreements using blockchain technology from inception. Smart contracts are, essentially, self-executing digital contracts with the contract clauses drafted in computer interpretable language (instead of human language in paper form). Under a smart contract, no money would be paid unless specific agreements are met and verified by software.

The benefits of smart contracts are tangible: they are easily and quickly created, easily accessible and immutable. Notably, they cannot be lost because they are placed on a blockchain; and because they are easy to create, they will be cheaper – bringing down the cost of associate fees. A big advantage is that the risk of a traditional contract dispute arising between the parties is reduced. Smart Contracts can also reduce the risk of fraud and corruption.

Smart contracts are cryptographically secure, self-enforcing digital instruments that can automate agreements between the parties. They are carefully designed and tested before being used in real-world applications.

WE ARE ASSISTING S EVERAL INNOVATORS IN DIGITAL CURRENCY SPACE RELATED TO INTERNATIONAL FRAUD IN CRYPTO CURRENCY.